Easy way to create ICO on Stellar network

07/04/18 21:54 Filed in: Blockchain

An Initial Coin Offering (ICO) is used by startups to bypass the rigorous and regulated capital-raising process required by venture capitalists or banks. In an ICO campaign, a percentage of the cryptocurrency is sold to early backers of the project in exchange for legal tender or other cryptocurrencies. The majority of the ICOs today are made on Ethereum (ERC20 token). But Ethereum is slow running transaction with high cost. If required to raise funds for the startup then Stellar can do a lot faster, better and cheaper, it is an open source platform for developing financial applications.

The advantages are:

• Less transaction fees

• Perform almost 100 time faster

• Less development effort to get ICO online.

• Tokens are available on Stellar Distributed Exchange in a day, where anyone can trade without waiting for it to get listed on other exchanges.

Stellar is an infrastructure for payments; connects banks, payments systems and people around the world, designed from the start to make it really easy for financial institutions to issue tokens representing fiat currencies. Also has built in distributed exchange which allows people to not only buy and sell currencies like in a typical foreign exchange way but also to seamlessly convert from one currency to another during cross border or cross currency transactions.

In this blog I have described how to create custom token on Stellar Network and accepting BTC/ETH contributions in an ICO. We will be using stellar laboratory and test network for this article. The functionalities provided here can be done through Stellar SDK as well. We need two accounts on Stellar to proceed, one is “Issuing account” and another is “Distributing account”. Although you could create tokens using one account but its always good to keep issuing account separate and use assets from distributing account.

Following tasks required:

1. Create issuer and distribution account. 2. Add trust

3. Issue Token

4. Freeze total supply

5. Selling token and accepting XLM

Accounts are the central data structure in Stellar. Accounts are identified by a public key and saved in the ledger and everything in the ledger is owned by a particular account. Account access is controlled by public/private key cryptography. For an account to perform a transaction–e.g., make a payment–the transaction must be signed by the private key that corresponds to that account’s public key.

Accounts have the following fields:

Account ID

The public key that was first used to create the account. You can replace the key used for signing the account’s transactions with a different public key, but the original account ID will always be used to identify the account.

Balance

The number of lumens held by the account. The balance is denominated in 1/10,000,000th of a lumen, the smallest divisible unit of a lumen.

Sequence number

The current transaction sequence number of the account. This number starts equal to the ledger number at which the account was created.

Number of subentries

Number of other entries the account owns. This number is used to calculate the account’s minimum balance.

Inflation destination

(optional) Account designated to receive inflation. Every account can vote to send inflation to a destination account.

Flags

Currently there are three flags, used by issuers of assets.

- Authorization required (0x1): Requires the issuing account to give other accounts permission before they can hold the issuing account’s credit.

- Authorization revocable (0x2): Allows the issuing account to revoke its credit held by other accounts.

- Authorization immutable (0x4): If this is set then none of the authorization flags can be set and the account can never be deleted.

Home domain

A domain name that can optionally be added to the account. Clients can look up a stellar.toml from this domain. This should be in the format of a fully qualified domain name such as example.com. The federation protocol can use the home domain to look up more details about a transaction’s memo or address details about an account. For more on federation, see the federation guide.

Thresholds

Operations have varying levels of access. This field specifies thresholds for low-, medium-, and high-access levels, as well as the weight of the master key. For more info, see multi-sig.

Signers

Used for multi-sig. This field lists other public keys and their weights, which can be used to authorize transactions for this account.

The process for creating issuing account and distributing account are same, its just a general concept to keep things separate. Save details of this account as well, we will be using this account to sell tokens. Follow the below instructions to create issuer and distribution accounts.

Steps

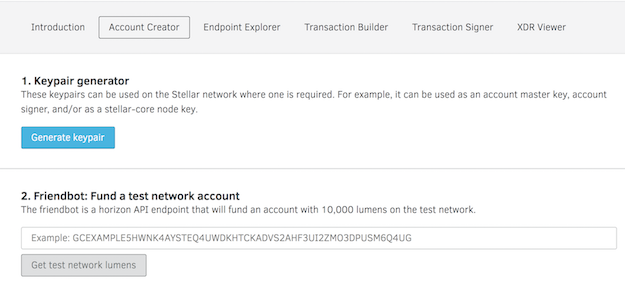

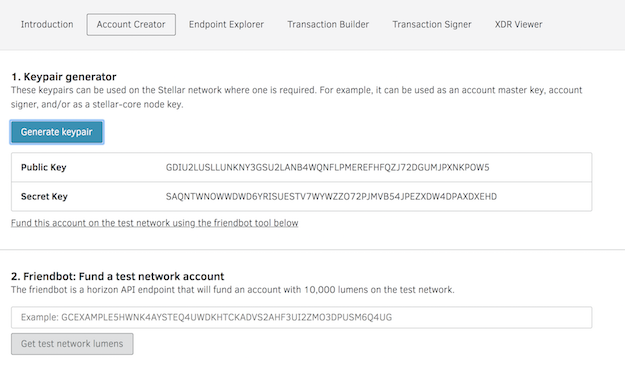

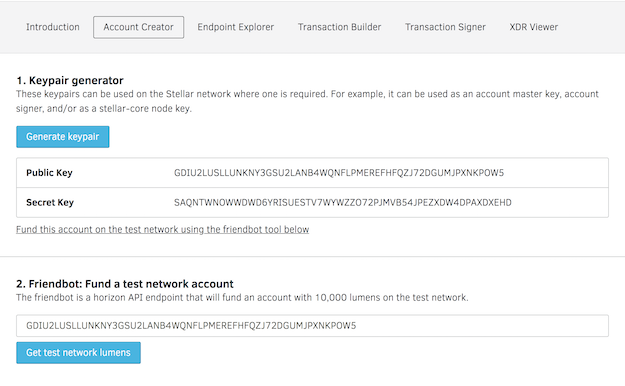

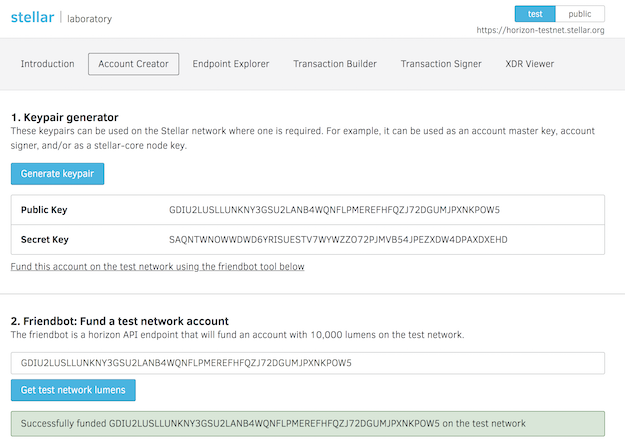

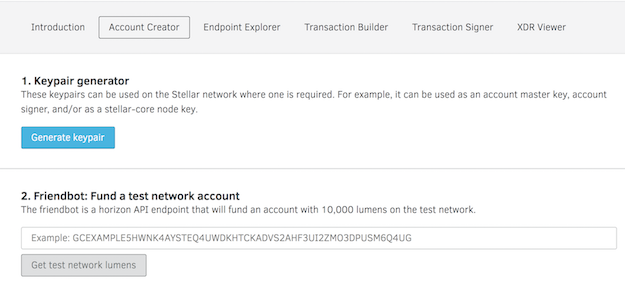

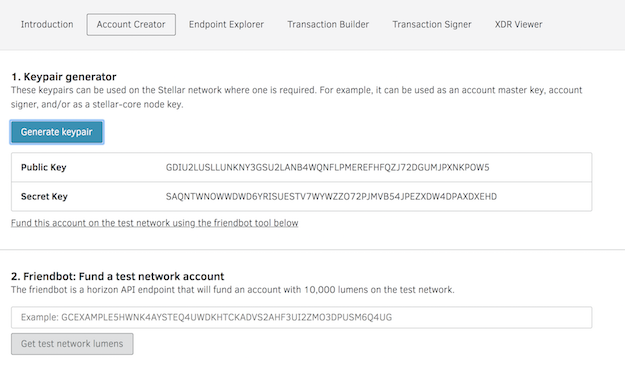

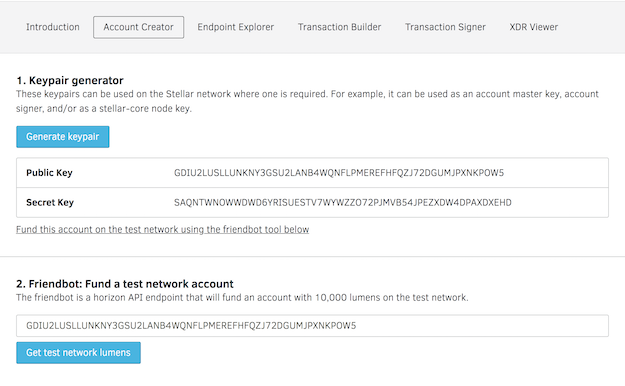

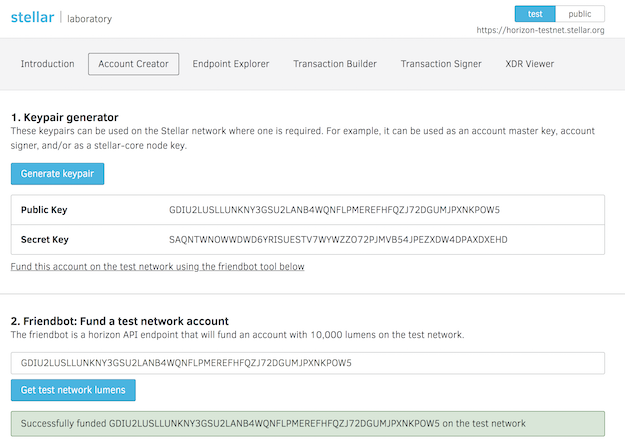

1. Goto https://www.stellar.org/laboratory/

2. Click on account creator tab.

3. Generate key pair - Save the public address and secret.

4. Fund the test Account - Use Friendbot available on the same tab to fund the test account.

Images are attached explaining screen flow.

The issuer test account details can be viewed by using GET URL

https://horizon-testnet.stellar.org/accounts/GBCVYWPJWSHBZCON75LQY5ZW7JWZRA63YU4EEILGFHZENMPZRT25PWQW

The distribution needs to trust the asset to receive tokens from issuing account. When someone buys token from the exchange they are already trusting the asset, but someone who has not purchased the asset before has to add the trustline in order to receive your tokens. Adding trust is easy as creating a transaction on stellar network.

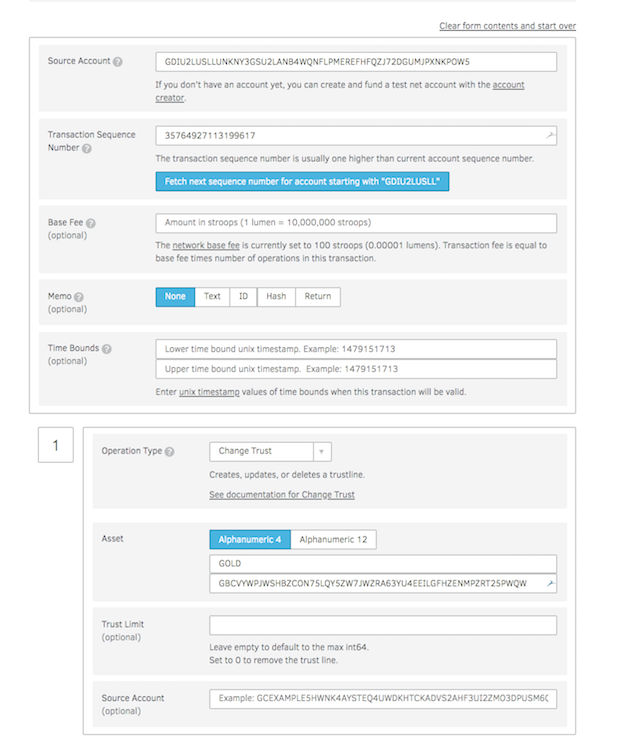

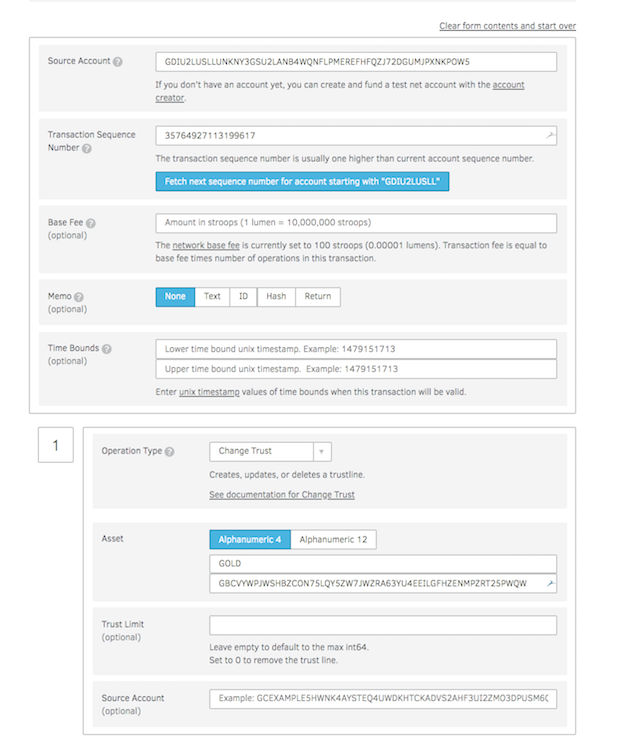

Go to the Transaction builder tab in the laboratory and fill in the following

1. Source account with distributing account number.

2. Click on “Fetch next sequence number ….”

3. Change operation type to “Change Trust”

4. Provide Asset code e.g: GOLD

5. Click on Sign in Transaction signer

If the transaction is successful you have successfully added trust for the new asset, which issuing account is about to send.

Assets

The Stellar distributed network can be used to track, hold, and transfer any type of asset: dollars, euros, bitcoin, stocks, gold, and other tokens of value. Any asset on the network can be traded and exchanged with any other. Other than lumens (see below), all assets have

- Asset type: e.g., USD or BTC

- Issuer: the account that created the asset

Trustlines

When you hold assets in Stellar, you’re actually holding credit from a particular issuer. The issuer has agreed that it will trade you its credit on the Stellar network for the corresponding asset–e.g., fiat currency, precious metal–outside of Stellar. When you hold an asset, you must trust the issuer to properly redeem its credit. Since users of Stellar will not want to trust just any issuer, accounts must explicitly trust an issuing account before they’re able to hold the issuer’s credit.

Lumens (XLM)

Lumens (XLM) are the native currency of the network. A lumen is the only asset type that can be used on the Stellar network that doesn’t require an issuer or a trustline. Any account can hold lumens. You can trade lumens for other assets in the network.

Anchors: issuing assets

Any account can issue assets on the Stellar network. Entities that issue assets are called anchors. Anchors can be run by individuals, small businesses, local communities, nonprofits, organizations, etc. Any type of financial institution–a bank, a payment processor–can be an anchor. Each anchor has an issuing account from which it issues the asset. As an anchor, when you issue an asset, you give it an asset code. Assets are uniquely identified by the asset code and the issuer. Ultimately, it’s up to the issuer to set the asset code. By convention, however, currencies should be represented by the appropriate ISO 4217 code. For stocks and bonds, use the appropriate ISIN number. For your orange, goat, favor, or beer anchors, you’re on your own–invent an appropriate code!

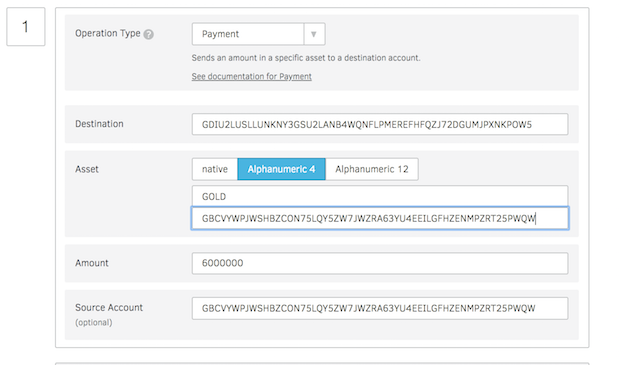

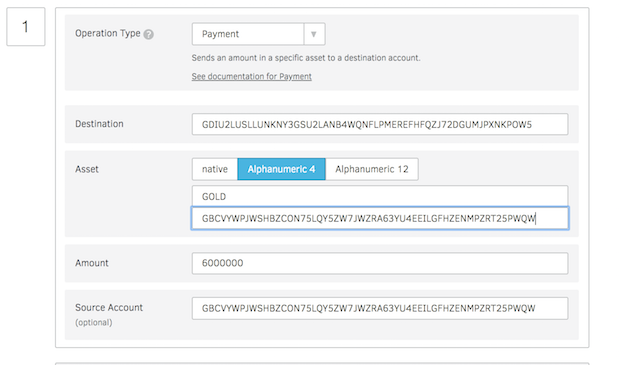

This section describe the payment process to the distributing account from issuing account of total tokens you want to generate. Go to transaction builder and refer below screen to fill up the form. Enter source address as issuing account address, fetch the next transaction number and than set option. After filling the information click on Sign in Transaction signers. If the transaction is successful you have successfully created a token on Stellar platform and sent it to distributing account from where it can be sold.

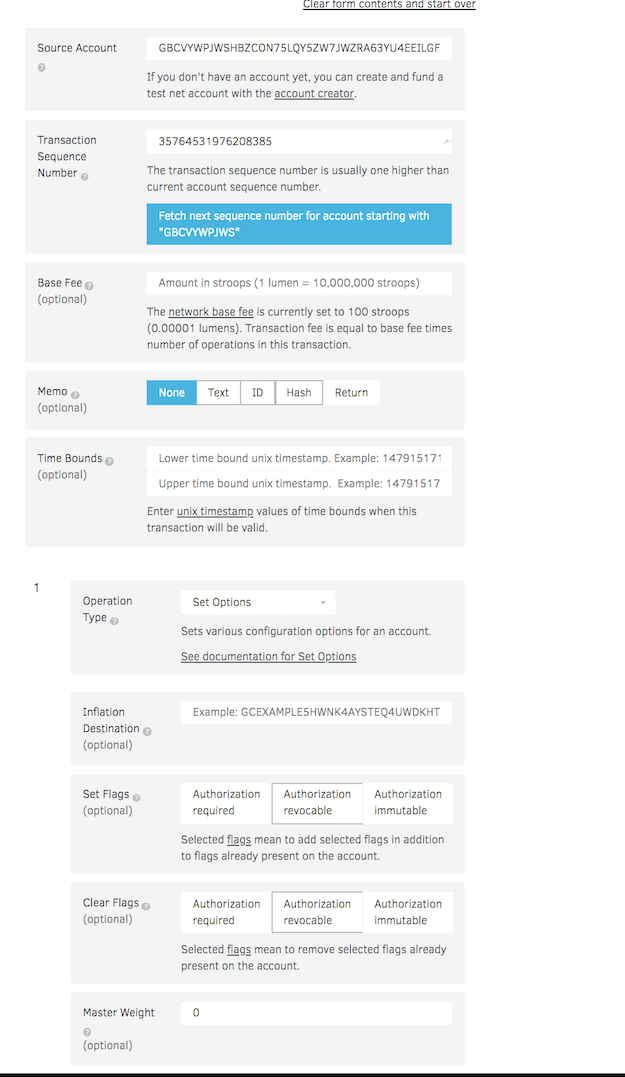

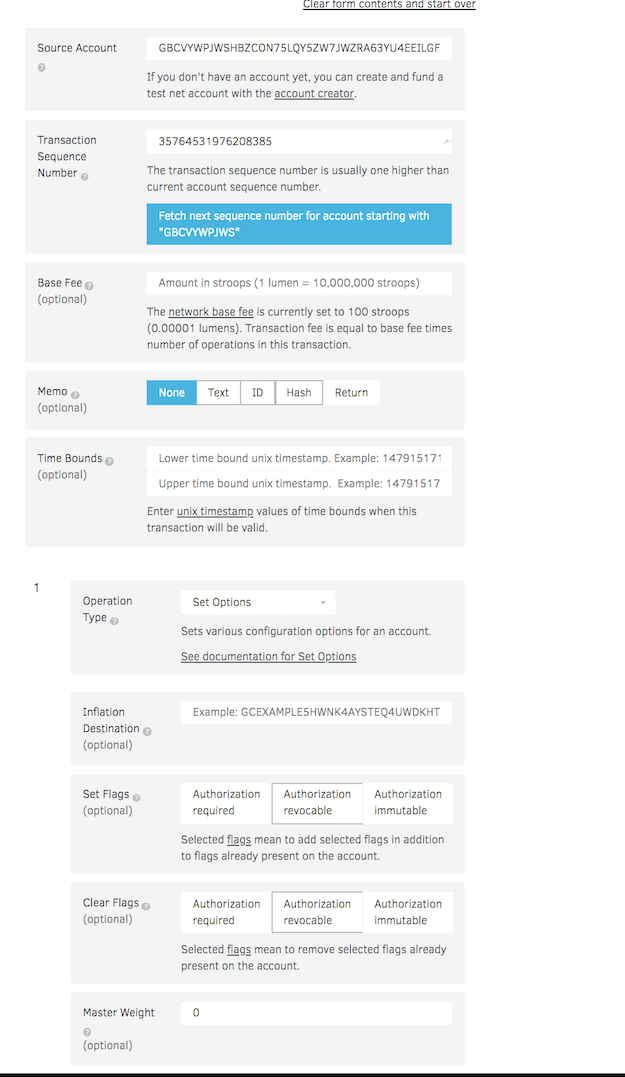

After completing the payment the issuing account should be freezes so no more tokens can be generated later. See below screen to set the freeze process.

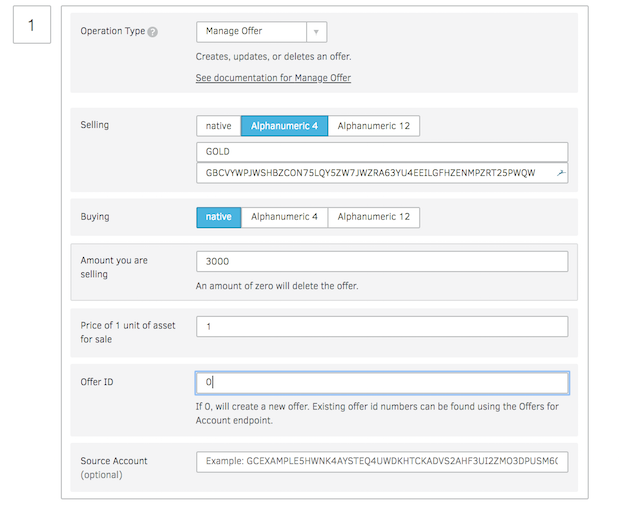

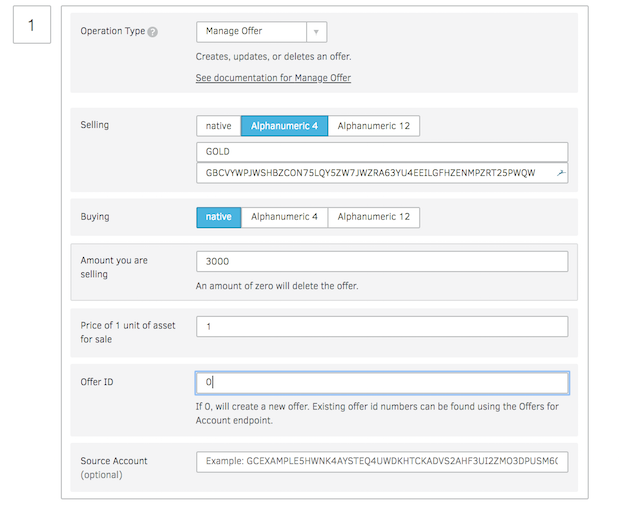

Using Stellar decentralized exchange, you can put a sell order with desired price and any one can buy the tokens. This accepts in XLM (native option) in Stellar platform. To accept in BTC/ETH need more development effort required.

The advantages are:

• Less transaction fees

• Perform almost 100 time faster

• Less development effort to get ICO online.

• Tokens are available on Stellar Distributed Exchange in a day, where anyone can trade without waiting for it to get listed on other exchanges.

Stellar is an infrastructure for payments; connects banks, payments systems and people around the world, designed from the start to make it really easy for financial institutions to issue tokens representing fiat currencies. Also has built in distributed exchange which allows people to not only buy and sell currencies like in a typical foreign exchange way but also to seamlessly convert from one currency to another during cross border or cross currency transactions.

In this blog I have described how to create custom token on Stellar Network and accepting BTC/ETH contributions in an ICO. We will be using stellar laboratory and test network for this article. The functionalities provided here can be done through Stellar SDK as well. We need two accounts on Stellar to proceed, one is “Issuing account” and another is “Distributing account”. Although you could create tokens using one account but its always good to keep issuing account separate and use assets from distributing account.

Following tasks required:

1. Create issuer and distribution account. 2. Add trust

3. Issue Token

4. Freeze total supply

5. Selling token and accepting XLM

Create issuer and distribution account

Accounts are the central data structure in Stellar. Accounts are identified by a public key and saved in the ledger and everything in the ledger is owned by a particular account. Account access is controlled by public/private key cryptography. For an account to perform a transaction–e.g., make a payment–the transaction must be signed by the private key that corresponds to that account’s public key.

Accounts have the following fields:

Account ID

The public key that was first used to create the account. You can replace the key used for signing the account’s transactions with a different public key, but the original account ID will always be used to identify the account.

Balance

The number of lumens held by the account. The balance is denominated in 1/10,000,000th of a lumen, the smallest divisible unit of a lumen.

Sequence number

The current transaction sequence number of the account. This number starts equal to the ledger number at which the account was created.

Number of subentries

Number of other entries the account owns. This number is used to calculate the account’s minimum balance.

Inflation destination

(optional) Account designated to receive inflation. Every account can vote to send inflation to a destination account.

Flags

Currently there are three flags, used by issuers of assets.

- Authorization required (0x1): Requires the issuing account to give other accounts permission before they can hold the issuing account’s credit.

- Authorization revocable (0x2): Allows the issuing account to revoke its credit held by other accounts.

- Authorization immutable (0x4): If this is set then none of the authorization flags can be set and the account can never be deleted.

Home domain

A domain name that can optionally be added to the account. Clients can look up a stellar.toml from this domain. This should be in the format of a fully qualified domain name such as example.com. The federation protocol can use the home domain to look up more details about a transaction’s memo or address details about an account. For more on federation, see the federation guide.

Thresholds

Operations have varying levels of access. This field specifies thresholds for low-, medium-, and high-access levels, as well as the weight of the master key. For more info, see multi-sig.

Signers

Used for multi-sig. This field lists other public keys and their weights, which can be used to authorize transactions for this account.

The process for creating issuing account and distributing account are same, its just a general concept to keep things separate. Save details of this account as well, we will be using this account to sell tokens. Follow the below instructions to create issuer and distribution accounts.

Steps

1. Goto https://www.stellar.org/laboratory/

2. Click on account creator tab.

3. Generate key pair - Save the public address and secret.

4. Fund the test Account - Use Friendbot available on the same tab to fund the test account.

Images are attached explaining screen flow.

The issuer test account details can be viewed by using GET URL

https://horizon-testnet.stellar.org/accounts/GBCVYWPJWSHBZCON75LQY5ZW7JWZRA63YU4EEILGFHZENMPZRT25PWQW

Add trust

The distribution needs to trust the asset to receive tokens from issuing account. When someone buys token from the exchange they are already trusting the asset, but someone who has not purchased the asset before has to add the trustline in order to receive your tokens. Adding trust is easy as creating a transaction on stellar network.

Go to the Transaction builder tab in the laboratory and fill in the following

1. Source account with distributing account number.

2. Click on “Fetch next sequence number ….”

3. Change operation type to “Change Trust”

4. Provide Asset code e.g: GOLD

5. Click on Sign in Transaction signer

If the transaction is successful you have successfully added trust for the new asset, which issuing account is about to send.

Assets

The Stellar distributed network can be used to track, hold, and transfer any type of asset: dollars, euros, bitcoin, stocks, gold, and other tokens of value. Any asset on the network can be traded and exchanged with any other. Other than lumens (see below), all assets have

- Asset type: e.g., USD or BTC

- Issuer: the account that created the asset

Trustlines

When you hold assets in Stellar, you’re actually holding credit from a particular issuer. The issuer has agreed that it will trade you its credit on the Stellar network for the corresponding asset–e.g., fiat currency, precious metal–outside of Stellar. When you hold an asset, you must trust the issuer to properly redeem its credit. Since users of Stellar will not want to trust just any issuer, accounts must explicitly trust an issuing account before they’re able to hold the issuer’s credit.

Lumens (XLM)

Lumens (XLM) are the native currency of the network. A lumen is the only asset type that can be used on the Stellar network that doesn’t require an issuer or a trustline. Any account can hold lumens. You can trade lumens for other assets in the network.

Anchors: issuing assets

Any account can issue assets on the Stellar network. Entities that issue assets are called anchors. Anchors can be run by individuals, small businesses, local communities, nonprofits, organizations, etc. Any type of financial institution–a bank, a payment processor–can be an anchor. Each anchor has an issuing account from which it issues the asset. As an anchor, when you issue an asset, you give it an asset code. Assets are uniquely identified by the asset code and the issuer. Ultimately, it’s up to the issuer to set the asset code. By convention, however, currencies should be represented by the appropriate ISO 4217 code. For stocks and bonds, use the appropriate ISIN number. For your orange, goat, favor, or beer anchors, you’re on your own–invent an appropriate code!

Issue Token

This section describe the payment process to the distributing account from issuing account of total tokens you want to generate. Go to transaction builder and refer below screen to fill up the form. Enter source address as issuing account address, fetch the next transaction number and than set option. After filling the information click on Sign in Transaction signers. If the transaction is successful you have successfully created a token on Stellar platform and sent it to distributing account from where it can be sold.

Freeze total supply

After completing the payment the issuing account should be freezes so no more tokens can be generated later. See below screen to set the freeze process.

Selling token and accepting XLM

Using Stellar decentralized exchange, you can put a sell order with desired price and any one can buy the tokens. This accepts in XLM (native option) in Stellar platform. To accept in BTC/ETH need more development effort required.

References

- Concepts definitions are from Stellar site : https://www.stellar.org/developers/guides/concepts/accounts.html

- Create ICO blog from Ashish Prajapati : https://medium.com/@ashisherc/create-an-ico-on-stellar-network-with-custom-token-7b6aab349f33